FAH – Mock Certification Exam

Mock Certification Exam Summary

0 of 60 Questions completed

Questions:

Information

You have already completed the mock certification exam before. Hence you can not start it again.

Mock Certification Exam is loading…

You must sign in or sign up to start the mock certification exam.

You must first complete the following:

Results

Results

0 of 60 Questions answered correctly

Your time:

Time has elapsed

You have reached 0 of 0 point(s), (0)

Earned Point(s): 0 of 0, (0)

0 Essay(s) Pending (Possible Point(s): 0)

Categories

- Not categorized 0%

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- Current

- Review

- Answered

- Correct

- Incorrect

- Question 1 of 60

1. Question

How many transaction event classes can be set up for a subledger uploaded to Accounting Hub Cloud?

CorrectIncorrect - Question 2 of 60

2. Question

What attribute of a subledger journal entry is NOT transferred to GL?

CorrectIncorrect - Question 3 of 60

3. Question

What feature is NOT provided by Fusion Accounting Hub Reporting Cloud Service (FAHRC)?

CorrectIncorrect - Question 4 of 60

4. Question

What is the terminology that is used to identify the “Account Number’, ‘Original Balance’, and ‘Origination Date’ fields?

CorrectIncorrect - Question 5 of 60

5. Question

Given the business use case:

‘New Trucks’ runs a fleet of trucks in a rental business In the U.S. The majority of the trucks are owned; however, in some cases, ‘New Truck’ may procure other trucks by renting them from third parties to their customers. When trucks are leased, the internal source code is ‘L’. When trucks are owned, the internal source code is ‘O’. This identifies different accounts used for the Journal entry. Customers sign a contract to initiate the truck rental for a specified duration period. The insurance fee is included in the contract and recognized over the rental period. For maintenance of the trucks, the “New Trucks” company has a subsidiary company ‘Fix Trucks’ that maintains its own profit and loss entity. To track all revenue, discounts, and maintenance expenses, ‘New Trucks’ needs to be able to view: total maintenance fee, total outstanding receivables, rental payment discounts, and total accrued and recognized insurance fee income.

How do you pass the calculated value for discount amounts in accounting rules to the corresponding journal line?CorrectIncorrect - Question 6 of 60

6. Question

What is a user job role data context assignment?

CorrectIncorrect - Question 7 of 60

7. Question

What automation option is NOT available when uploading transaction data to Accounting Hub Cloud?

CorrectIncorrect - Question 8 of 60

8. Question

In the process of analyzing data from a source system you find that there are no reliable amounts that can be used to build a subledger journal entry. How can you resolve this challenge?

CorrectIncorrect - Question 9 of 60

9. Question

Most of the accounting entries for transaction from the source system use TRANSACTION_AMOUNT as a source of the entered amount accounting attribute. For some events, you need to use the TAX_AMOUNT source.

At what level can you override the default accounting attribute assignment?CorrectIncorrect - Question 10 of 60

10. Question

Given the business use case:

‘Insurances for Homes’ company provides home insurance services. They have an in-house built system that processes insurance payments received from customers. The end result of the process consists of a listing of individual journal entries in a spreadsheet. They have requirements for get t ing all Journal entries in a secure and auditable repository. Access will be limited to selective staff members. Additionally, the company need to be able to report and view the entries using advanced reporting and analytical tools for segmenting, viewing and understanding data in the journal entries.

The line information may contain more than one line for the same header. When

uploading transactions, which is a way to differentiate each Journal line?CorrectIncorrect - Question 11 of 60

11. Question

What is the recommended approach for a use case in which some parts of the transaction data must be processed before uploading them to Accounting Hub Cloud?

CorrectIncorrect - Question 12 of 60

12. Question

You are explaining to an accountant that account override is an adjustment feature of Subledger Accounting.

Which two traits can help you explain this feature?CorrectIncorrect - Question 13 of 60

13. Question

What can you override in a completed subledger journal entry?

CorrectIncorrect - Question 14 of 60

14. Question

There is a business requirement to display supporting information with some text and source value at the journal line level that will vary depending on the entered amounts for the line. What is the solution to implement this requirement?

CorrectIncorrect - Question 15 of 60

15. Question

You have created a description rule. When you try to select this description rule to be displayed as a header description rule in a journal entry rule set, you are not able to find this rule in the list of values. What is the possible reason for NOT finding the rule?

CorrectIncorrect - Question 16 of 60

16. Question

Given the business use case:

‘New Trucks’ runs a fleet of trucks in a rental business In the U.S. The majority of the trucks are owned; however, in some cases, ‘New Truck’ may procure other trucks by renting them from third parties to their customers. When trucks are leased, the internal source code is ‘L’. When trucks are owned, the internal source code is ‘O’. This identifies different accounts used for the Journal entry. Customers sign a contract to initiate the truck rental for a specified duration period. The insurance fee is included in the contract and recognized over the rental period. For maintenance of the trucks, the “New Trucks* company has a subsidiary company ‘Fix Trucks’ that maintains its own profit and loss entity. To track all revenue, discounts, and maintenance expenses, ‘New Trucks’ needs to be able to view: total maintenance fee, total outstanding receivables, rental payment discounts, and total accrued and recognized insurance fee income.

How do you calculate discounts for use in the accounting rule?CorrectIncorrect - Question 17 of 60

17. Question

‘Insurances for Homes’ company provide home insurance service. They have in-house built system that processes home insurance payments received from customers. The end result of the process consists of a listing of individual journal entries in a spreadsheet. They have requirements for get t ing all journal entries in a secure and auditable repository. Access will be limited to selective staff members. Additionally, be able to report and view the entries using an advanced reporting and analytical tools for slicing and dicing the Journal entries.

Which is a correct example for a formula to prorate amounts evenly across each period? Note that the NumberofGLPeriod is a predefined function that returns the number of non-adjustment accounting periods between two dates.CorrectIncorrect - Question 18 of 60

18. Question

Given the business use case:

‘New Trucks’ runs a fleet of trucks in a rental business In the U.S. The majority of the trucks are owned; however, in some cases, ‘New Truck’ may procure other trucks by renting them from third parties to their customers. When trucks are leased, the internal source code is ‘L’. When trucks are owned, the internal source code is ‘O’. This identifies different accounts used for the Journal entry. Customers sign a contract to initiate the truck rental for a specified duration period. The insurance fee is included in the contract and recognized over the rental period. For maintenance of the trucks, the “New Trucks” company has a subsidiary company ‘Fix Trucks’ that maintains its own profit and loss entity. To track all revenue, discounts, and maintenance expenses, ‘New Trucks’ needs to be able to view: total maintenance fee, total outstanding receivables, rental payment discounts, and total accrued and recognized insurance fee income.

What do you do to enable costs flow from ‘New Truck’ to ‘Fix Truck’?CorrectIncorrect - Question 19 of 60

19. Question

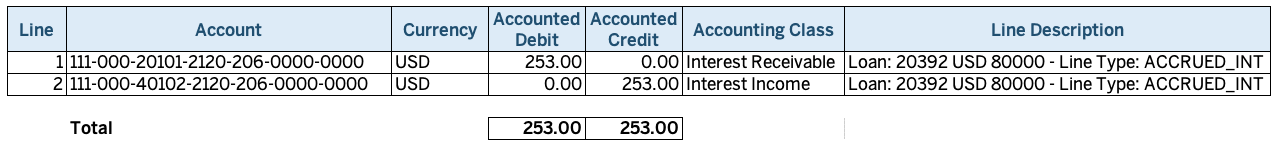

Note that the first segment is the primary balancing segment. Which statement is True regarding this subledger journal entry?

CorrectIncorrect - Question 20 of 60

20. Question

CorrectIncorrect - Question 21 of 60

21. Question

Given the business use case:

‘New Trucks’ runs a fleet of trucks in a rental business In the U.S. The majority of the trucks are owned; however, In some cases, ‘New Truck’ may procure other trucks by renting them from third parties to their customers. When trucks are leased, the Internal source code is ‘L’. When trucks are owned, the internal source code is ‘O’. This identifies different accounts used for the Journal entry. Customers sign a contract to initiate the truck rental for a specified duration period. The insurance fee is included in the contract and recognized over the rental period. For maintenance of the trucks, the “New Trucks* company has a subsidiary company ‘Fix Trucks’ that maintains its own profit and loss entity. To track all revenue, discounts, and maintenance expenses, ‘New Trucks’ needs to be able to view: total maintenance fee, total outstanding receivables, rental payment discounts, and total accrued and recognized insurance fee income. ‘New Trucks’ and’ Fix Trucks’ are located in the same country and share chart-of accounts and accounting conventions. How many ledgers are required to be set up?CorrectIncorrect - Question 22 of 60

22. Question

Given the business use case:

‘New Trucks’ runs a fleet of trucks in a rental business In the U.S. The majority of the trucks are owned; however, in some cases, ‘New Truck’ may procure other trucks by renting them from third parties to their customers. When trucks are leased, the internal source code is ‘L’. When trucks are owned, the internal source code is ‘O’. This identifies different accounts used for the Journal entry. Customers sign a contract to initiate the truck rental for a specified duration period. The insurance fee is included in the contract and recognized over the rental period. For maintenance of the trucks, the “New Trucks” company has a subsidiary company ‘Fix Trucks’ that maintains its own profit and loss entity. To track all revenue, discounts, and maintenance expenses, ‘New Trucks’ needs to be able to view: total maintenance fee, total outstanding receivables, rental payment discounts, and total accrued and recognized insurance fee income.

What will the typical transaction information be at the header level?CorrectIncorrect - Question 23 of 60

23. Question

Given the business requirement in the use case:

‘New Trucks’ runs a fleet of trucks in a rental business In the U.S. The majority of the trucks are owned; however, in some cases, ‘New Truck’ may procure other trucks by renting them from third parties to their customers. When trucks are leased, the internal source code is ‘L’. When trucks are owned, the internal source code is ‘O’. This identifies different accounts used for the Journal entry. Customers sign a contract to initiate the truck rental for a specified duration period. The insurance fee is included in the contract and recognized over the rental period. For maintenance of the trucks, the “New Trucks” company has a subsidiary company ‘Fix Trucks’ that maintains its own profit and loss entity. To track all revenue, discounts, and maintenance expenses, ‘New Trucks’ needs to be able to view: total maintenance fee, total outstanding receivables, rental payment discounts, and total accrued and recognized insurance fee income.

What are the key transaction types mentioned in the use case?CorrectIncorrect - Question 24 of 60

24. Question

Given the business use case:

‘New Trucks’ runs a fleet of trucks in a rental business In the U.S. The majority of the trucks are owned; however, in some cases, ‘New Truck’ may procure other trucks by renting them from third parties to their customers. When trucks are leased, the internal source code is ‘L’. When trucks are owned, the internal source code is ‘O’. This identifies different accounts used for the Journal entry. Customers sign a contract to initiate the truck rental for a specified duration period. The insurance fee is included in the contract and recognized over the rental period. For maintenance of the trucks, the “New Trucks” company has a subsidiary company ‘Fix Trucks’ that maintains its own profit and loss entity. To track all revenue, discounts, and maintenance expenses, ‘New Trucks’ needs to be able to view: total maintenance fee, total outstanding receivables, rental payment discounts, and total accrued and recognized insurance fee income.

What would the typical line information be?CorrectIncorrect - Question 25 of 60

25. Question

How do you enable diagnostics on subledger transaction sources?

CorrectIncorrect - Question 26 of 60

26. Question

You have been assigned to troubleshoot a Create Accounting error.

What is the first step you need to take to use the diagnostics framework features?CorrectIncorrect - Question 27 of 60

27. Question

‘Insurances for Homes’ company provide home insurance service. They have in house built system that processes home insurance payments received from customers. The end result of the process consists of a listing of individual journal entries in a spreadsheet. They have requirements for getting all journal entries in a secure and auditable repository. Access will be limited to selective staff members. Additionally, be able to report and view the entries using an advanced reporting and analytical tools for slicing and dicing the Journal entries.

Insurance premium is to be recognized as income across the-coverage period of the insurance policy. How do you link the two journal lines in the recurring journal entries cases, so that these two journal lines are identified by the accounting process to create recurring Journal entries?CorrectIncorrect - Question 28 of 60

28. Question

‘Insurances for Homes’ company provide home insurance service. They have in-house built system that processes home insurance payments received from customers. The end result of the process consists of a listing of individual journal entries in a spreadsheet. They have requirements for getting all journal entries in a secure and auditable repository. Access will be limited to selective staff members. Additionally, be able to report and view the entries using an advanced reporting and analytical tools for slicing and dicing the journal entries.

Insurance premium Is to be recognized as income across the coverage period of the insurance policy. What are the two types of journal lines that need to be set up to generate recurring journal entries for insurance premium in each accounting period?CorrectIncorrect - Question 29 of 60

29. Question

Given the business use case:

‘New Trucks’ runs a fleet of trucks in a rental business In the U.S. The majority of the trucks are owned; however, in some cases, ‘New Truck’ may procure other trucks by renting them from third parties to their customers. When trucks are leased, the internal source code is ‘L’. When trucks are owned, the internal source code is ‘O’. This identifies different accounts used for the Journal entry. Customers sign a contract to initiate the truck rental for a specified duration period. The insurance fee is included in the contract and recognized over the rental period. For maintenance of the trucks, the “New Trucks” company has a subsidiary company ‘Fix Trucks’ that maintains its own profit and loss entity. To track all revenue, discounts, and maintenance expenses, ‘New Trucks’ needs to be able to view: total maintenance fee, total outstanding receivables, rental payment discounts, and total accrued and recognized insurance fee income.

How can the automatic recognition of insurance income be implemented in Accounting Hub Cloud?CorrectIncorrect - Question 30 of 60

30. Question

A new source system has been registered into Accounting Hub Cloud. Users are actively using this new subledqer. Subsequently, the business signed up a contract with a new supplier. A new mapping value that maps suppliers with the accounts needs to be added. You make updates on the mappings in the existing mapping set rule by adding more mapping valued. After saving the update, what is the next required action?

CorrectIncorrect - Question 31 of 60

31. Question

Which is an alternate way to implement a mapping set rule?

CorrectIncorrect - Question 32 of 60

32. Question

Invoices received from a source system need to use a specific account based on 30 different expense types. However, if the invoice is from a certain supplier type, it needs to go to a default account regardless of the expense type.

What is the solution?CorrectIncorrect - Question 33 of 60

33. Question

Given the business use case:

‘New Trucks’ runs a fleet of trucks in a rental business In the U.S. The majority of the trucks are owned; however, in some cases, ‘New Truck’ may procure other trucks by renting them from third parties to their customers. When trucks are leased, the internal source code is ‘L’. When trucks are owned, the internal source code is ‘O’. This identifies different accounts used for the Journal entry. Customers sign a contract to initiate the truck rental for a specified duration period. The insurance fee is included in the contract and recognized over the rental period. For maintenance of the trucks, the “New Trucks* company has a subsidiary company ‘Fix Trucks’ that maintains its own profit and loss entity. To track all revenue, discounts, and maintenance expenses, ‘New Trucks’ needs to be able to view: total maintenance fee, total outstanding receivables, rental payment discounts, and total accrued and recognized insurance fee income.

How do you set up an account rule that is based on leased and owned trucks?CorrectIncorrect - Question 34 of 60

34. Question

Which two options allow validating input values on mapping sets?

CorrectIncorrect - Question 35 of 60

35. Question

You need to build a complex account rule. Which four value types can you use in your definition?

CorrectIncorrect - Question 36 of 60

36. Question

A financial analyst at your workplace would like to frequently view Journal entries report with all line details attributes with user’s specific set of criteria and pivot table. What is the solution to implement this requirement quickly?

CorrectIncorrect - Question 37 of 60

37. Question

After supporting references balances setup component is tagged to subledger journal entries, what type of reports need to be created so that the information is available to users?

CorrectIncorrect - Question 38 of 60

38. Question

Which two can you use to view supporting reference balances?

CorrectIncorrect - Question 39 of 60

39. Question

Which three duty roles are required to perform Accounting Hub setup tasks?

CorrectIncorrect - Question 40 of 60

40. Question

A customer has a business requirement to provide additional information about subledger Journals that cannot be found in a predefined report.

How can you meet this requirement?CorrectIncorrect - Question 41 of 60

41. Question

What is the duty role that needs to be assigned for authorizing accounting processing in Accounting Hub Cloud?

CorrectIncorrect - Question 42 of 60

42. Question

What is the required date format used to import accounting transactions to Accounting Hub Cloud?

CorrectIncorrect - Question 43 of 60

43. Question

The new billing source system has been registered into Accounting Hub Cloud. The subledger is in active state. At a later date, the business decides to bring in another legacy system (for example, a payment system) for accounting in Accounting Hub. What two options do you have?

CorrectIncorrect - Question 44 of 60

44. Question

What are all the tabs that are available to be completed in the Register Source System spreadsheet?

CorrectIncorrect - Question 45 of 60

45. Question

Which transaction source is used to link transaction header and line information?

CorrectIncorrect - Question 46 of 60

46. Question

Which three are mandatory transaction source information?

CorrectIncorrect - Question 47 of 60

47. Question

What is the key attribute that is used to query journal entries of a registered source system?

CorrectIncorrect - Question 48 of 60

48. Question

To support foreign currency transaction in Accounting Hub, which accounting attributes must be assigned a source?

CorrectIncorrect - Question 49 of 60

49. Question

After registering a new source system into Accounting Hub and going live for a short period, your customer identified the need to add additional transaction sources. What should you do?

CorrectIncorrect - Question 50 of 60

50. Question

Which is used to track a specific transaction attribute on subledger journal entries?

CorrectIncorrect - Question 51 of 60

51. Question

You are implementing Fusion Accounting Hub for your external Accounts Receivables system. The external system sends invoices billed and cash receipts in a flat file, along with the customer classification information. You want the accounting amounts to be tracked by customers too but you do not want to add a Customer segment to your chart of accounts. What is the solution?

CorrectIncorrect - Question 52 of 60

52. Question

Which two actions can you accomplish for a registered source system?

CorrectIncorrect - Question 53 of 60

53. Question

A customer has four external systems: Consumer Loan, Auto Loan, Home Loan and Insurance. Functional users are allowed to process and view transactions and accounting for all these systems. Which two implementations allow similar accounting rules to be shared?

CorrectIncorrect - Question 54 of 60

54. Question

Where do you define the currency conversion type to be used in converting accounted amount for reporting currency ledger?

CorrectIncorrect - Question 55 of 60

55. Question

While creating a journal entry rule set you are NOT able to use an account rule that was created recently.

Which two reasons can explain this?CorrectIncorrect - Question 56 of 60

56. Question

What are the tables or views from which the Create Accounting process takes source data that is used in accounting rules to create journal entries referred to as?

CorrectIncorrect - Question 57 of 60

57. Question

A customer’s business requirement demands a more granular view of transferred subledger journal entries in GL.

Which of the available General Ledger Journal Entry Summarization options meets this requirement?CorrectIncorrect - Question 58 of 60

58. Question

What kind of sequence can be assigned to subledger journal entries at the time that the journal entries are created in final mode?

CorrectIncorrect - Question 59 of 60

59. Question

What is NOT included in the minimum required accounting attribute assignments?

CorrectIncorrect - Question 60 of 60

60. Question

What is the terminology that is used to refer to the number of transactions processed by Create Accounting in one commit cycle?

CorrectIncorrect